增值稅 Reverse Charge 機(jī)制是什么?

時(shí)間:2019-09-06 14:49 編輯:長沙代理記賬

在跨境交易中,常會(huì)提到增值稅的反向征收機(jī)制[reverse charge mechanism],這個(gè)機(jī)制的作用和原理,以及和代扣代繳機(jī)制的區(qū)別是什么呢?

作用

簡單來說,其目的就是,當(dāng)境外一方向境內(nèi)提供服務(wù)等時(shí),無需在境內(nèi)進(jìn)行稅務(wù)登記,就可以繳稅。

該機(jī)制常見于歐洲國家的增值稅政策。以英國為例,其政府官網(wǎng)的稅政指南中對(duì)該機(jī)制的描述如下:

The reverse charge is a simplification measure to avoid the need for suppliers to register in the member state where they supply their services.

It only applies where services are supplied in the UK by a supplier belonging overseas.

依據(jù)英國政府官網(wǎng)的稅政指南,除了免稅項(xiàng)目之外,該反向征稅機(jī)制幾乎適用于所有的B2B服務(wù)交易。特殊的是,其不適用于土地交易,針對(duì)土地交易,有選擇付稅機(jī)制[編者注:Option to Tax簡單來說就是可以選擇放棄免稅,適用交稅,這樣相關(guān)的增值稅進(jìn)項(xiàng)就可以抵扣了]

The reverse charge applies to almost all B2B supplies of services except exempt supplies.It does not apply to land on which the option to tax has been exercised(see section 7 for more details).In this circumstance the non-UK supplier must register and account for VAT in the UK.

方式

舉例,W國的甲公司給D國的乙公司提供了法律咨詢服務(wù),獲得服務(wù)收入,一般來說,此種情況下,D國對(duì)該跨國交易有征稅權(quán),W國對(duì)出口的該服務(wù)規(guī)定的是零稅率。相較于D國直接對(duì)甲公司征稅,由乙公司來申報(bào)繳稅更便于征管。

在反向征稅機(jī)制下,乙公司代為申報(bào)該服務(wù)收入的增值稅,長沙公司注冊(cè),同時(shí)申報(bào)繳納的增值稅構(gòu)成乙公司的進(jìn)項(xiàng)。換句話說,乙公司會(huì)貸記自己的增值稅銷項(xiàng),同時(shí)借記增值稅進(jìn)項(xiàng)。

除非在特殊情況下,比如乙公司的該進(jìn)項(xiàng)被歸集為和其免稅收入相對(duì)應(yīng),否則,反向征稅機(jī)制下,乙公司繳納的增值稅并不構(gòu)成其成本或費(fèi)用。

對(duì)此,英國政府官網(wǎng)的描述如下:

You simply credit your VAT account with an amount of output tax,calculated on the full value of the supply you've received,and at the same time debit your VAT account with the input tax to which you are entitled,in accordance with the normal rules.

和Withholding的區(qū)別

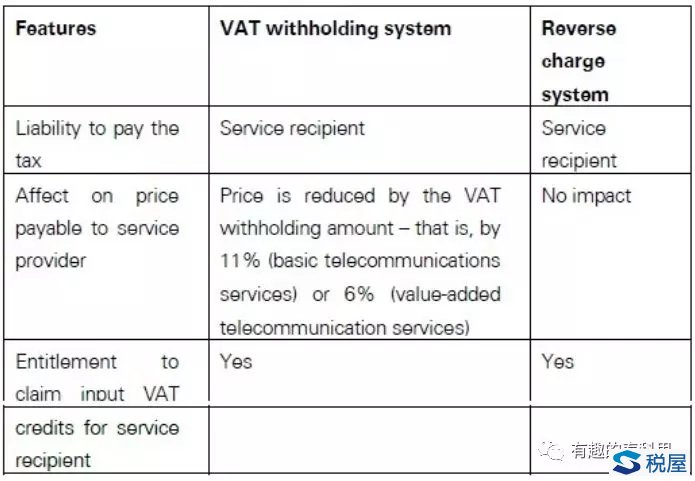

我國目前采用的代扣代繳機(jī)制[withholding system],跟反向征稅機(jī)制[reverse charge mechanism]非常類似,但也有一些區(qū)別,其中關(guān)鍵的區(qū)別是前者影響價(jià)格,后者不影響價(jià)格,是基于交易額直接計(jì)算增值稅。

KPMG對(duì)兩者差異的匯總?cè)缦拢?/p>

It is important to recoganise that the VAT system in China is a withholding system,not a reverse charge system as is commonly used internationally.The key differences are: